Disclaimer: The analyst who wrote this report owns shares of Strategy (MSTR).

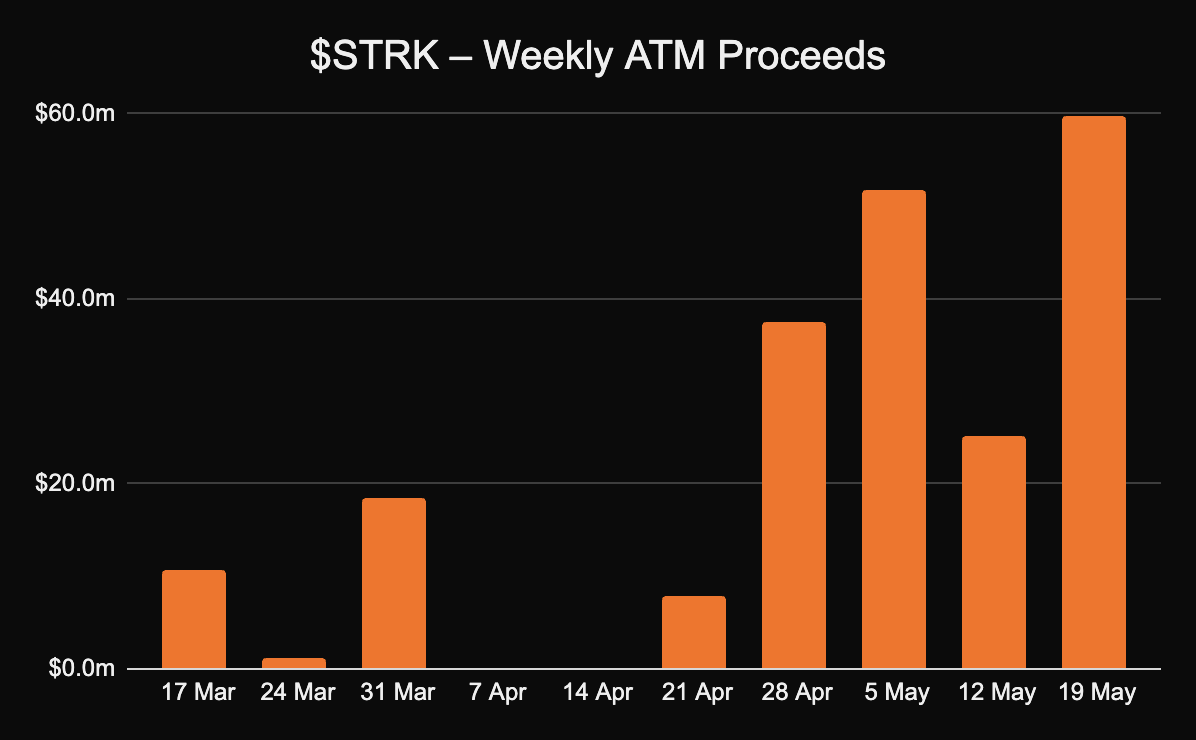

Strategy’s (MSTR) perpetual preferred stock, STRK, achieved the largest proceeds from its weekly at-the-market (ATM) issuance since the program started in February, according to X account DogCandles, raising $59.7 million that was used to buy more bitcoin BTC, according to a Monday SEC filing.

That amount corresponds to the issuance of approximately 621,555 STRK shares. Strategy has about $20.79 billion still available in the STRK ATM facility.

The company led by Executive Chairman Michael Saylor is plowing ahead with its bitcoin-buying strategy even as the price of the largest cryptocurrency holds above $100,000, with an eye on its January record of $109,000. Strategy’s Monday BTC purchase took its total holdings to 576,230 BTC.

This represents a 16.3% BTC yield, a key performance indicator (KPI) that reflects the year-to-date percentage increase in the ratio of MSTR’s bitcoin holdings to its assumed diluted shares outstanding, effectively measuring the growth in BTC exposure on a per-share basis.

The recent STRK issuance represents just under 9% of the total proceeds generated from the ATM program for the common stock, which has raised $705.7 million to date. This highlights the increasing role STRK is playing in Strategy’s bitcoin acquisition model.

STRK features a fixed 8% annual dividend, which is based on the $100 per share liquidation preference, resulting in an annual payout of $8.00 per share.

That gives it an effective yield, annual dividend divided by STRK share price, of 8.1%. Importantly, this yield is inversely related to the share price. As STRK trades higher, the yield decreases, and vice versa.

Since its launch on Feb. 10, STRK has risen by 16%, outperforming both bitcoin, which has added 10%, and the S&P 500, which has declined by 2% over the same period.

According to data from the Strategy dashboard, STRK exhibits the lowest correlation with MSTR common stock, sitting at just 44%. In contrast, STRK maintains relatively higher correlations with broader market benchmarks: 71% with bitcoin and 72% with the SPY exchange-traded fund.

This suggests that STRK trades with a unique profile, potentially appealing to investors seeking differentiated exposure due to its hybrid nature as a preferred equity instrument with bitcoin-tied capital deployment.