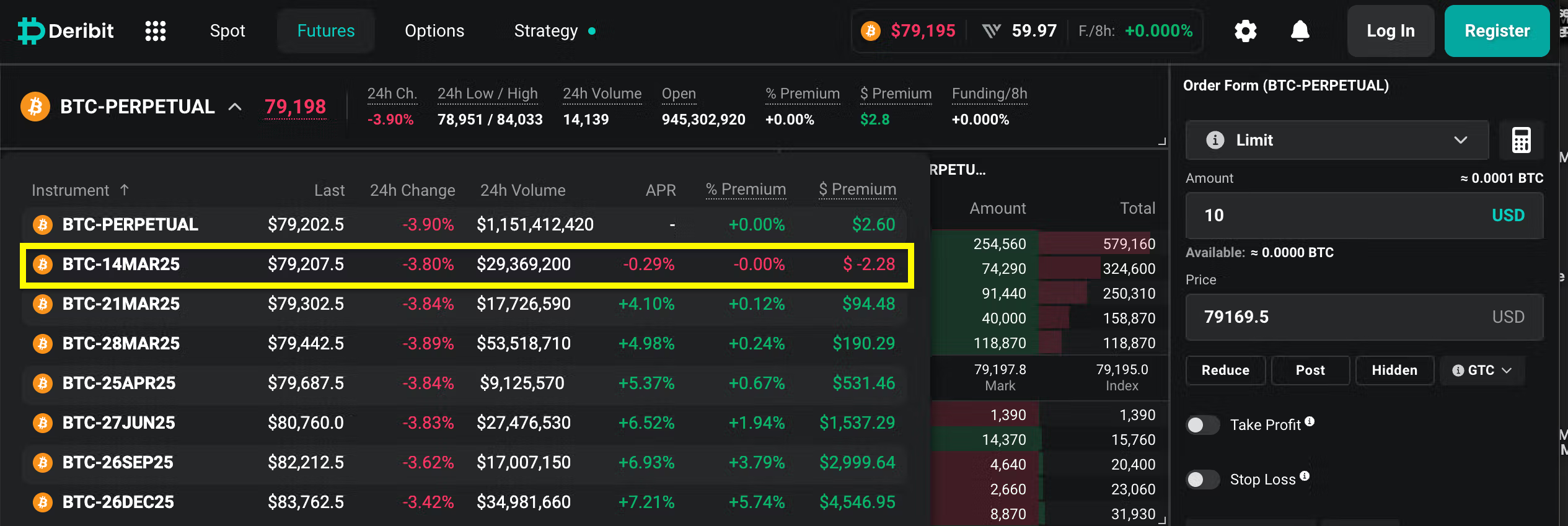

Deribit-listed bitcoin (BTC) futures set to expire this Friday now trade marginally below the exchange’s index price, flashing a discount in a sign of weak demand for the cryptocurrency.

“What we have seen is that near-tenor (7d and shorter) yields have dipped to the negative for the first time in over a year,” Andrew Melville, a research analyst at Block Scholes told CoinDesk in a Telegram chat. “This means that futures prices are trading below spot, which we take as a significantly bearish indicator.”

Deribit is the world’s leading crypto options exchange and a preferred venue for sophisticated traders looking to employ synthetic strategies involving futures, options and spot markets.