A broad crypto rally led by ether’s (ETH) 20% surge triggered more than $750 million in short liquidations in the past 24 hours, the highest single-day total since 2023 for bearish trades.

Data from CoinGlass shows that over 84% of the total liquidations came from shorts, with major altcoins jumping 10%–20% in the span of a few hours starting late Thursday.

Ether led the charge with a 20% rise, pushing past $2,000 for the first time since early March. DOGE and Cardano’s ADA zoomed more than 10%, fueled by bullish sentiment and momentum trading, with Solana’s SOL, BNB and xrp (XRP) up at least 7%.

Liquidations occur when an exchange forcibly closes a trader’s leveraged position due to insufficient margin. It happens when a trader cannot meet the margin requirements for a leveraged position, that is, when they don’t have sufficient funds to keep the trade open.

Large-scale liquidations can indicate market extremes, like panic selling or buying. A cascade of liquidations might suggest a market turning point, where a price reversal could be imminent due to an overreaction in market sentiment.

As such, the uptick in crypto markets came as bitcoin surged above $100,000 on Thursday, with sentiment buoyed on a trade deal between the U.S. and the UK.

The late Thursday wipeout ranks among the most severe since Bitcoin’s run to $93,000 in March, which saw bears lose over $550 million in a weekend squeeze.

In April, a similar rally in ETH and DOGE erased $500 million in shorts — but this move surpassed both, showing renewed risk appetite and a crowded short trade setup.

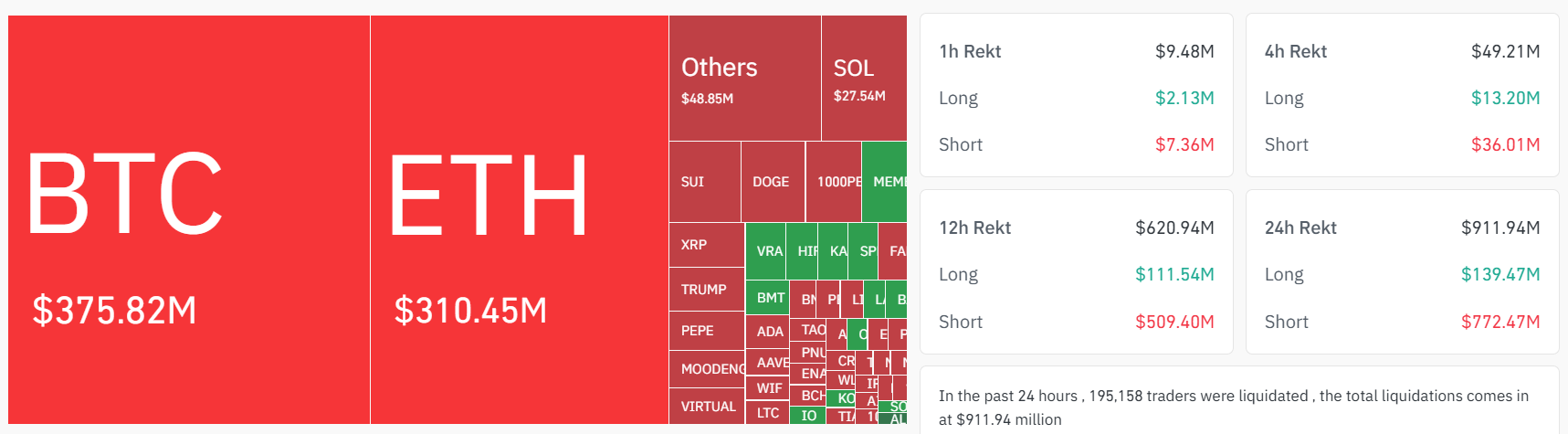

Coinglass data shows that the largest share of losses came from Binance and OKX, which accounted for more than $500 million in liquidations. ETH alone was responsible for over $310 million, while bitcoin-tracked futures led at $375 million.

The short squeeze on ETH came as the asset had been rangebound for a few weeks amid falling institutional interest and retail sentiment. But Ethereum’s recent Pectra upgrade may be giving traders a reason to bet on the asset, some say.